WithSecure™ Pulse23

All you need to know about the latest IT and cyber security trends.

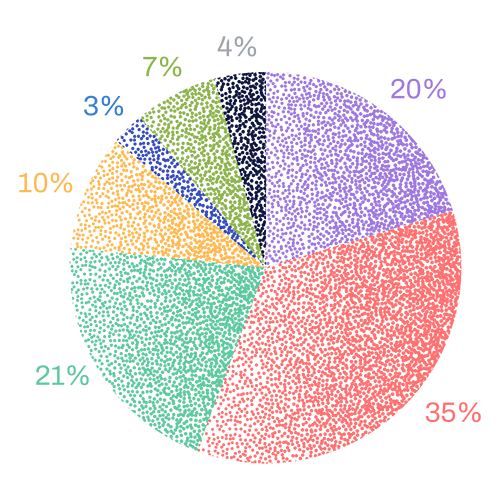

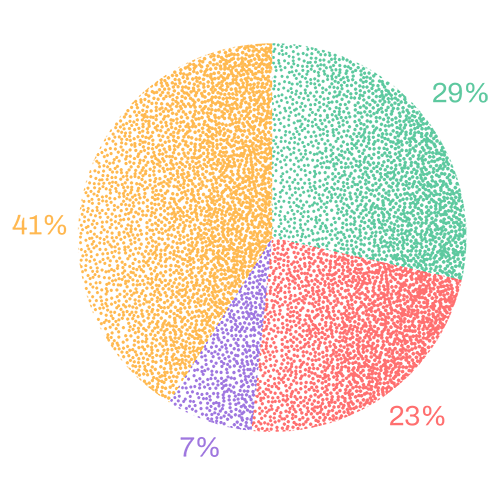

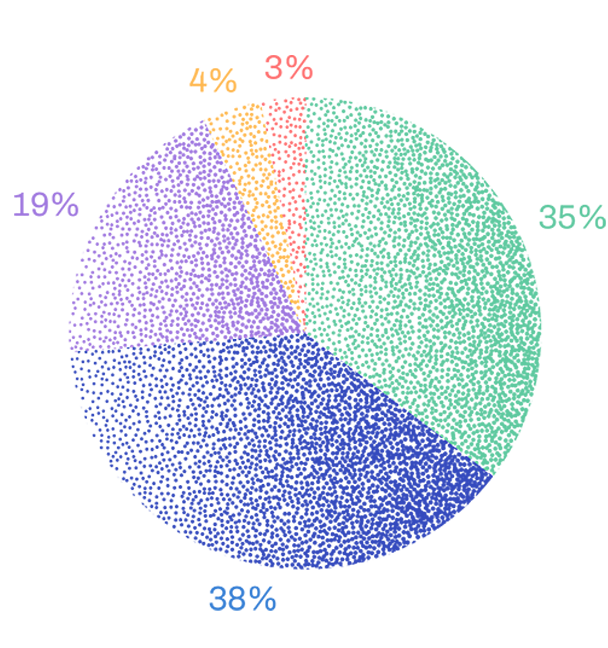

Where you keep the data

How important is geographic location to data processing in your role?

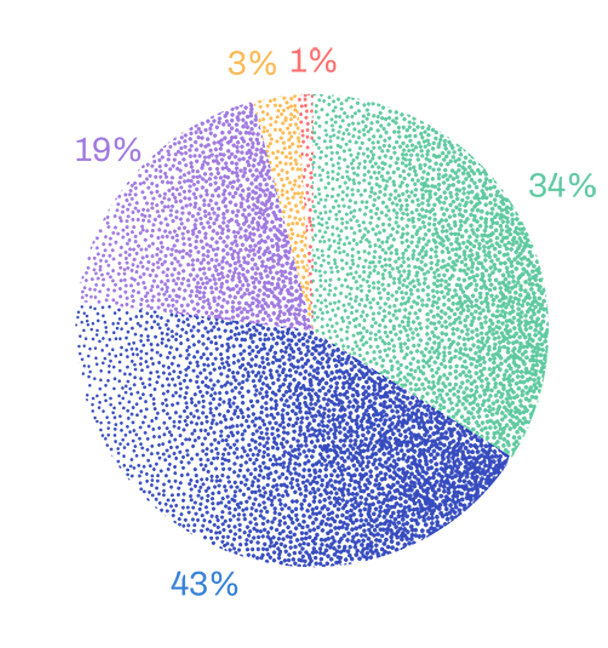

Total

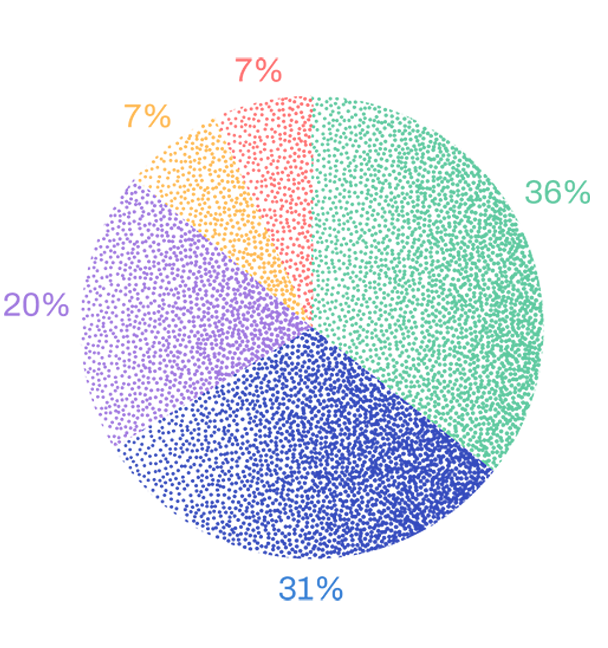

IT Deciders

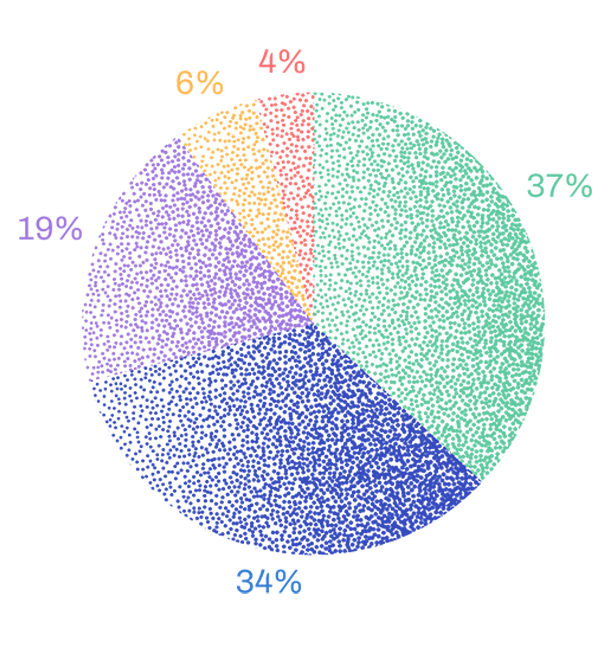

IT Influencers

Top Management

Data must be processed within the same country as our operations.

Data must be processed within the same region (e.g. EU, North America, APAC) as our operations.

It is of no importance where we process our end-customer data as long as all relevant legal and compliance requirements are met.

We do not process data for end-customers.

I don't know.

“Data residency is something you have to consider as a company operating today. The reason being is that you might have customers who care about national security issues, and you as a start-up, for example, might have provided your software as a service product utilizing American cloud service providers. Is that something you can continue doing, can you continue to innovate at the same pace as previously, or do you have to find an alternative solution to that? That is something you need to consider.”

Alberto Koubov Gonzalez, Consultant, WithSecure

Related content

Read more

Read more